Starting a personal savings journey may be an intimidating task but is something that must be taken seriously to take your financial health to the next level, be in control of your finances, and ace adulting.

There is no one-size-fits-all solution when it comes to handling personal finances because each person has unique preferences. It is important to consider personal habits, priorities, and life responsibilities when planning your savings journey.

Here are practical tips that have personally worked for me when I started my savings journey.

1. Keep a separate account for savings.

Do not fall for the rookie mistake of using the same bank account for your payroll and savings.

Why: You’ll most likely be unable to save and end up using this account to pay the bills, utilities, or rent, on top of other fixed expenses.

Tip: Open a new account – preferably a passbook-only account to make it harder for you to take money out, and keep this exclusively as your personal savings account.

Level up: Open multiple accounts and assign one for each important aspect of your life. I have separate accounts for bills payment, travel fund, personal emergency, family emergency, and savings account.

Take note: Be mindful of penalties charged on accounts that go below the minimum amount. Banks impose a minimum amount that each account must maintain and are usually in the range of Php 2,000 for regular savings account or Php5,000 for passbook accounts. The minimum amount vary depending on the Bank you opened your account with.

2. Automatic deductions.

Allocate a fixed amount for savings every pay day then auto-deduct or auto-transfer this amount straight to your separate personal savings account.

Why: Auto deductions will help form a strict habit and force yourself into saving a portion of your salary every pay day.

Tip: Know your average monthly expenses versus your total earnings. List down expenses to see what is the realistic amount that can be allocated for savings through auto-deductions.

Level Up: Try incorporating the basic 50/30/20 rule which means allocating 50% of your salary for needs, 30% for wants, and 20% for savings. You may also opt to switch the wants and savings allocations; this will increase your savings while minimising your wants to grow your savings nest faster. Remember, there is no strict allocation rule and you may adjust as necessary.

Take Note: Being realistic is key because expenses are fluid and emergency scenarios are always a possibility. Allocating for wants is also important – this will allow you to reward yourself to keep you inspired and optimistic about your savings journey

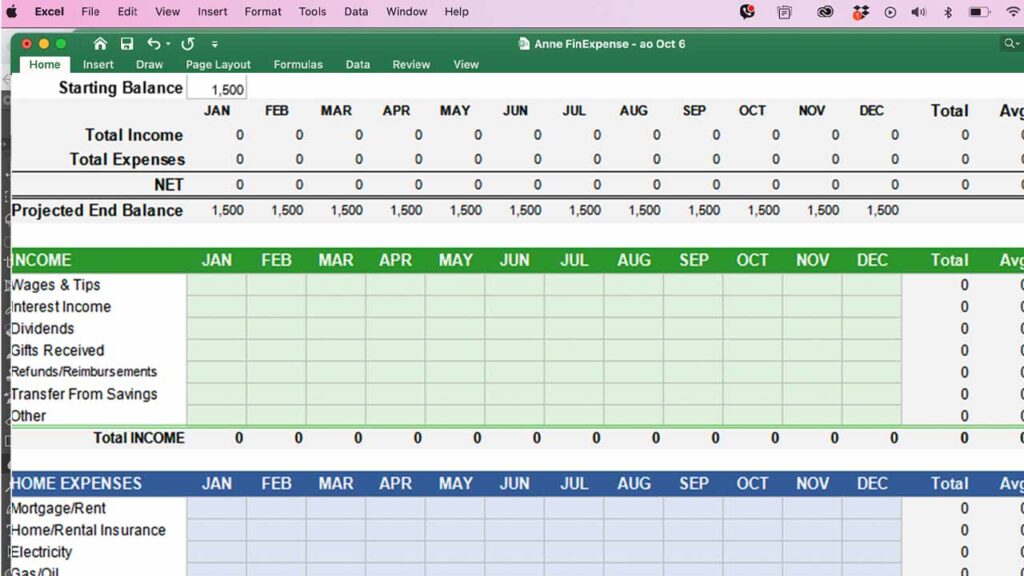

3. Track your funds and expenses.

Keep a record and tally available funds (credit) vs expenses (debit) in an excel file to see how your money flows. This will give you a clearer picture of the progress of your savings journey.

Why: Seeing actual expenses in a single file will allow you to prioritize which you can cut back on – like daily coffee runs or Grab rides, and let you adjust allocation for savings.

Tip: Handwritten records or ledgers are ok but keeping an excel file is more convenient and efficient. Formula and other customisations can be done in excel making it easier to update records.

Level Up: Keep a record of expenses – such as utility or credit card payments, as well as a record of each of your savings accounts. Do not rely on digital bank records through banking apps as these are available for online viewing for a limited time, usually only up to 90 days.

Take note: Keep your files as long as you can. Create new sheets or tabs per year on your excel sheet and carry over finance records from previous to the current year. This will show your progress – where you are in terms of your savings journey and inspire you to be more conscious in handling your finances. This will also allow you to see gaps in your savings strategy.

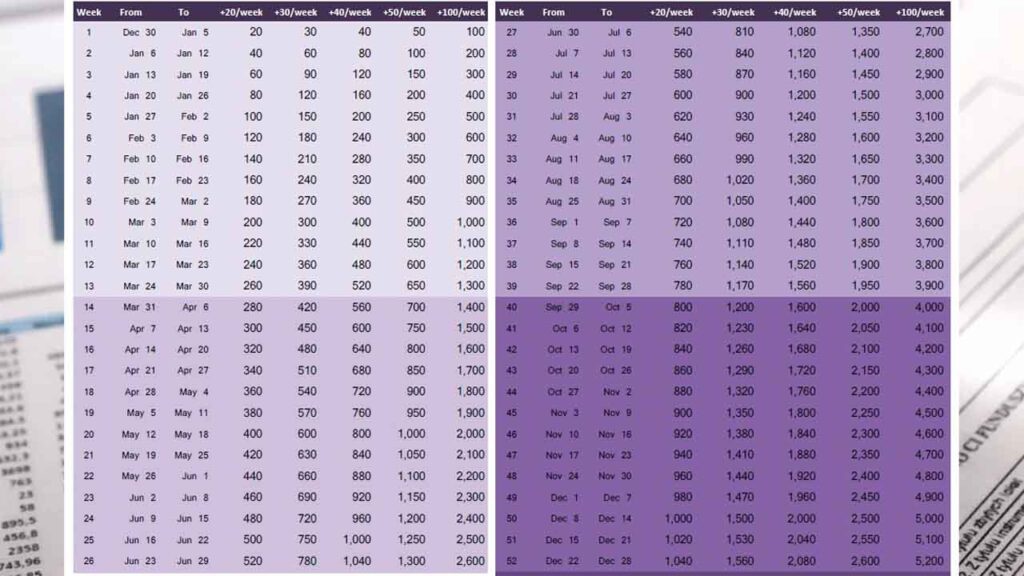

4. Gamify!

Those 20 peso-challenges and weekly saving challenges do work! But remember to find the right challenge that fits your lifestyle.

Why: Challenges allow you to focus on a singular goal and completing it will give a triumphant winning moment.

Tip: Choose realistic money challenges within your budget because failing to do so might lead to demotivation and affect your entire savings journey.

Level up: Start with daily or weekly challenges to gauge your capacity. Once comfortable, proceed to yearly challenges for bigger savings yield.

Take Note: Keep a printed copy of your chosen challenge. Cross out every completed challenge to keep you inspired to push on to the harder levels and eventually complete the program.

5. Diversify your funds to level up your savings journey.

As the old saying goes, never put all your eggs in one basket. This is especially true in handling personal finances. As your savings journey level up, you should look into different financial products and tools to further help you grow your savings nest.

Why: Economic inflation rates (usually within 3-6% rates) will eat the purchasing power of your money in the bank if you let it sleep in regular accounts such as savings, checking, or passbook accounts, because these types of accounts offer minuscule interest rates compared to other bank products.

Tip: Traditional banks let your regular savings account grow at around 0.1 to .85% interest per annum while digital banks offer significantly higher rates at 2 to 4.5% interest rates, and at times offer promotional rates up to 6%.

Level Up: For newbies, learn about time deposit and Long Term Negotiable Contract Deposit (LTNCD). For those ready to take on the next step, learn about Variable Universal Life Insurance (VUL) and Unit Investment Trust Funds (UITF), and Treasury bonds. For those who are aggressive, learn about stock market trading.

Remember that savings and financial health is personal. Never compare yourself with others as each person has different circumstances in life that need to be factored in for a successful savings journey. What’s important is to learn how to save wisely for the future and to keep on improving your financial literacy to achieve your personal financial goals.

Photos from unsplash.com and the 52 week challenge table is available here.